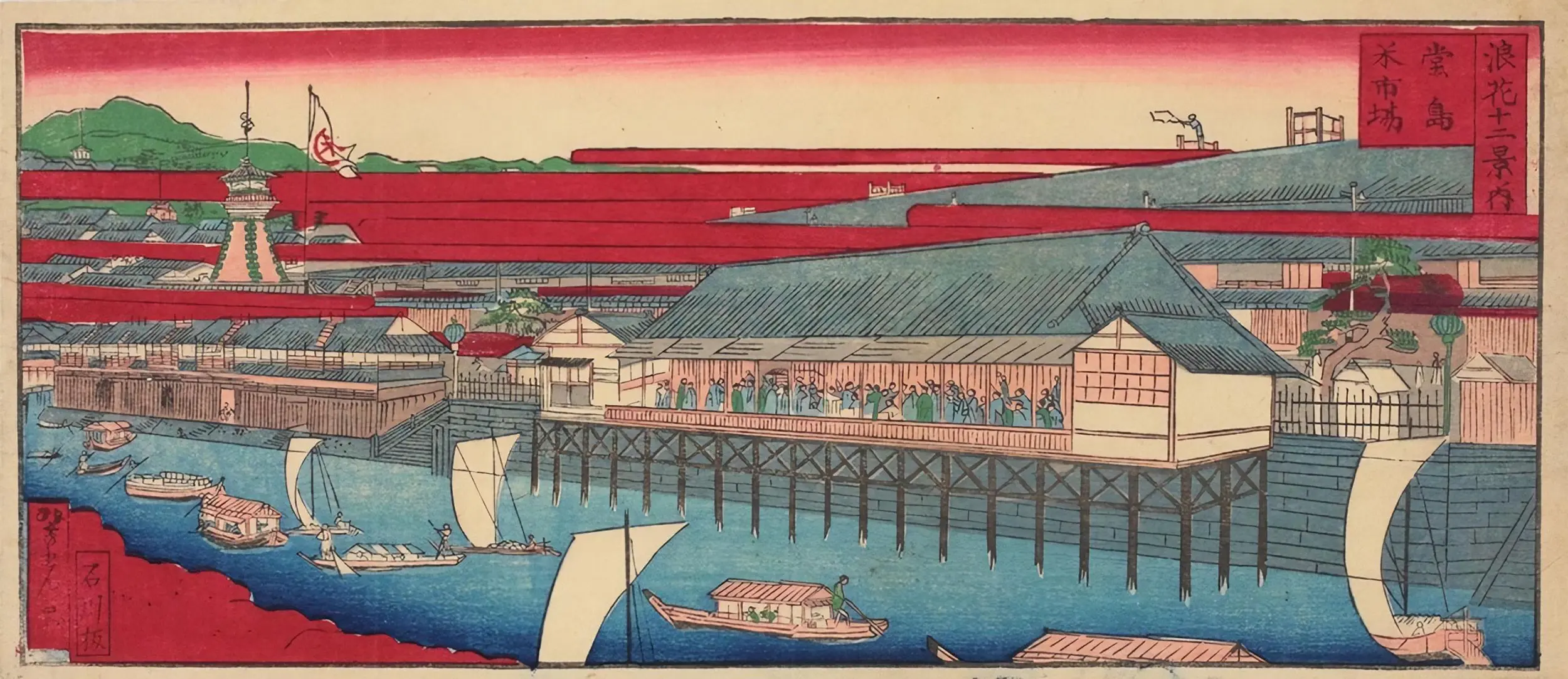

The Dōjima futures exchange

The Dojima rice exchange is a fascinating piece of history: this small island in the Osaka river delta was the world’s first futures exchange, in late seventeenth and eighteenth century Japan.

In the west, futures trading is generally accepted to have begun in the late 19th century: in Frankfurt in 1867, Chicago in 1871, and London in 1877. But almost two centuries earlier, the rice exchange at Dojima was operating on much the same principles.

At the time, there were a number of official currencies in use in Japan—gold, silver, iron, and copper coins were all in circulation. But in the wake of Tokugawa’s unification of Japan in the seventeenth century followed an era of relative prosperity, in which demand for hard currency rapidly outpaced supply.

Rice was easy to measure and readily available, unlike official currencies, and thus became a vital substitute currency. Samurai were paid in rice, taxes were largely levied in rice, and the shogunate measured its budget in rice. The basic denomination was the koku—around 150 kilograms, intended to represent the amount it takes to feed one person for one year.

The coastal city of Osaka is and was a major commercial hub and a center for rice shipment. To handle all the rice that flowed through the city, warehouses sprung up that offered to store rice in exchange for a fee, and Osaka became the place to be for anyone who wanted to buy, sell, or store rice. Though at this point it was still purely a commodity market, dealing in the buying and selling of physical rice, it is rather impractical to carry around even a single koku—so the actual exchange would often be of receipts for rice stored in one of the warehouses.

As lively as this commerce was, this in and of itself was not unique or unprecedented. Trade in commodities—even abstracted into financial instruments representing the underlying physical assets—was hardly a new concept, unlike what would come next.

There is, however, a major problem with using rice as a currency. There is a reason, after all, why most currency historically was metal, or at least somewhat durable. Rice is perishable, and the amount which grows each year is heavily weather-dependent. Thus its value fluctuates wildly from year to year, which, as you can imagine, was quite a problem for those whose salary or tax obligations were denominated in koku.

You may recognize this as the problem that futures contracts exist to solve—if you owe a certain number of koku in taxes next year, and you don’t want a bad year for rice to make you unable to pay it, you’d be well served by buying rice futures: you pay now for the delivery of a predetermined amount of rice on a certain date in the future, no matter what happens to the price of rice in the meantime.

Likewise, if you’re a farmer who has planted his yearly crop of rice, you’re in a precarious position when planning for the next year: if the price of rice goes down, you’re not going to be able to realize the current value of your growing crops, and so you’re not going to be able to buy all those things you were planning on buying with the money. So you’d do well to sell a futures contract: get paid today to deliver a certain amount of your rice on a certain date in the future, and thus lock in the current value of at least a part of your crop.

The traditional (though most likely apocryphal) origin story for the rice futures traded on the Dojima rice exchange is that a Nagoya rice merchant by the name of Chozaemon met a friend of his from Sendai (in the north of Japan), who let him know that the rice harvest in the north the next year was going to be extremely bad. Using this information, Chozameon buys rice from that year’s southern bumper crop. Another Nagoyan, named Ichizaemon, hears of this and wants in on it—he asks Chozameon to buy and store around 500 ryo1 worth of rice for him in exchange for a fee. Chozameon’s warehouses are already full with the rice from his own speculation, so instead they strike this bargain: Ichizaemon will pay Chozameon 60 ryo now, and next year, if the price of rice has gone up (compared to this year), Ichizaemon will pay the other 440 ryo, plus 3 sho2 of rice as interest, and receive the profits. But if the price of rice falls, Ichizaemon will be out the 60 ryo.

In effect, Chozameon sold Ichizaemon what we would understand to be a (cash-settled) call option on rice futures. The price of rice indeed went up that year, Ichizaemon was able to exercise the option for a considerable profit, and meanwhile Chozaemon realizes he can make this a regular thing. He goes on to sell rice receipts that are different from the existing rice receipts sold at the time in Osaka in an important way—they entitle the bearer not to rice on demand, but rather at a given maturity date two or three months in the future.

By 1654 there was a lively market in Osaka for these so-called kumai kitte, “empty bills” that were not tied to physical rice stored in a warehouse. The trade in such bills developed into an institution which would be quite familiar to anyone used familiar with modern securities trading practices: standardized lot sizes (of 100 koku), priced via auction, of transferable contracts, recorded in an order book.

Much like Chozameon’s original deal with Ichizaemon, these futures contracts were mostly cash-settled, with no need for physical delivery of any rice. Just as the rice warehouses that dotted Osaka existed for the sake of being able to trade rice without physically hauling it from place to place, those who traded futures at Dojima felt no need to physically move any rice when settling the contracts. The seller of a futures contract, who now (on the expiry date) has to deliver, could and often would deliver an amount of money equal to the spot price of rice as of that date. This level of financial abstraction is one of the exceptional things that sets Dojima apart as being far ahead of its time.

One additional valuable thing that futures exchanges provide are price signals: an auction of rice futures reveals a lot about what the participants think about the future availability of (and demand for) rice. Though it was quite a distance from Osaka to the capital city of Edo,3 normally considered a six-day journey, an intricate system of flag signals, smoke signals, and carrier pigeons was used to convey Dojima’s price information there as quickly as possible.

Although many features of the way the Dojima futures exchange worked are quite reminiscent of those we use today, it also had a few that are strange to us. One of those is how the length of the trading day was determined: Trading opened every morning at 8 am, and at that time a fuse-cord would be lighted in a wooden box. When this fuse burnt itself out, trading would end for the day, and the day’s closing price would be determined (typically based on the last trade of the day.) This “fuse-cord price” would then be used as the starting price the next day, as well as the price used for marking-to-market and for settling contracts linked to the price of rice futures.

Traders were not always particularly intent on following this rule, and often attempted to continue trading even after the official market close. As such, “watermen” on horseback were employed to splash water over the trading floor in an attempt to disperse the crowd of busy traders, escalating if needed into throwing entire buckets of water on those traders who tried to stick around and continue with their trading.

If the fuse blew out early, or if a closing price couldn’t be computed for whatever reason, the entire day’s worth of trades would be considered void. This seems to have served a similar purpose to the price movement limits in modern futures exchanges: on days of excessive volatility, trading could be ended early to give things a chance to settle down a bit, before reopening the next day.

This also was a way to restrict attempts at “cornering”, “dumping”, or otherwise trading in ways that were considered manipulative: if at some point it became clear that a trader was trying to do one of those things, the rest of the traders would abandon the trading floor, making it impossible to determine a closing price and thus voiding the day’s trades, causing a reset to the status quo of the day before.

The downside of this system was that it encouraged traders who had suffered losses during the day to attempt to disturb the trading floor just before closing time, such as by charging through on horseback, or else to try to extinguish the fuse. Such disturbances became more and more common as time went on, and by the end of the Tokugawa period they had become the norm, eventually leading to the system’s final breakdown. That said, for most of the period of operation this system worked surprisingly effectively, for all its quirks.

Further reading:

- Private Ordering at the World’s First Futures Exchange

- The Dojima Rice Market and the Origins of Futures Trading

- The Japanese Economy in the Tokugawa Era, 1600-1868